Data, Data, Everywhere!

A unique scandal in which nothing was hidden by the company. And still no one saw it coming. Until..

One hot afternoon on Oct 23rd, 2006 in Hoston, Texas, Jeffery K. Skilling, Criminal No. H-04-25 was looking at the Judge delivering the verdict.

‘The evidence established that the defendant repeatedly lied to investors, including his own employees, about various aspects of the company’s business’ The Judge read out his punishment: severe imprisonment for 292 months - 24 years.

Skilling wasn’t a murderer or a rapist. He headed Enron. One of Fortune’s most admired company in the world, till that year. He now received one of the heaviest sentences ever given to a white-collar criminal.

It started in July 2000, when Jonathan Weil, a financial reporter with the WSJ got a call from his source in the investment business to check on Enron : ‘How and where their earnings come from?’ Weil got curious. There was a lot of information available and he got on to it. Soon, he realised, it was an avalanche - ‘there was so much noise’ around the financial information that it took him more than 2 months and expert help from senior Professors in Finance and Accounting to get to the bottom.

The first revelation was on how Enron used the ‘Mark to Market’ accounting practice:

Enron enters into a $100 mn contract with the state of California to deliver 1 bn kwh of electricty AFTER 10 years.

Enron will not get paid for 10 years. But it must estimate the worth of the contract at the time of signing.

If electricity prices rise after 10 years, Enron makes a loss. If the prices fall, Enron gains.

Enron used ‘Mark to Market’ accounting to estimate the revenue this deal would bring. And then they put that estimate of the revenue on their balance sheets at the time of signing the contract. 10 years ahead.

Weil now wanted to know how much of this money Enron said it was making was real. Turned out that in the 2nd quarter of 2000, $747 million of the money Enron said it had made, was not realized - that is, there was no cash flow. It was imaginary money and if that number was taken away from Enron’s balance sheet, they had made severe loss in that quarter. The most admired company in the US, 7th largest corporation on Wall Street, had no cash flow.

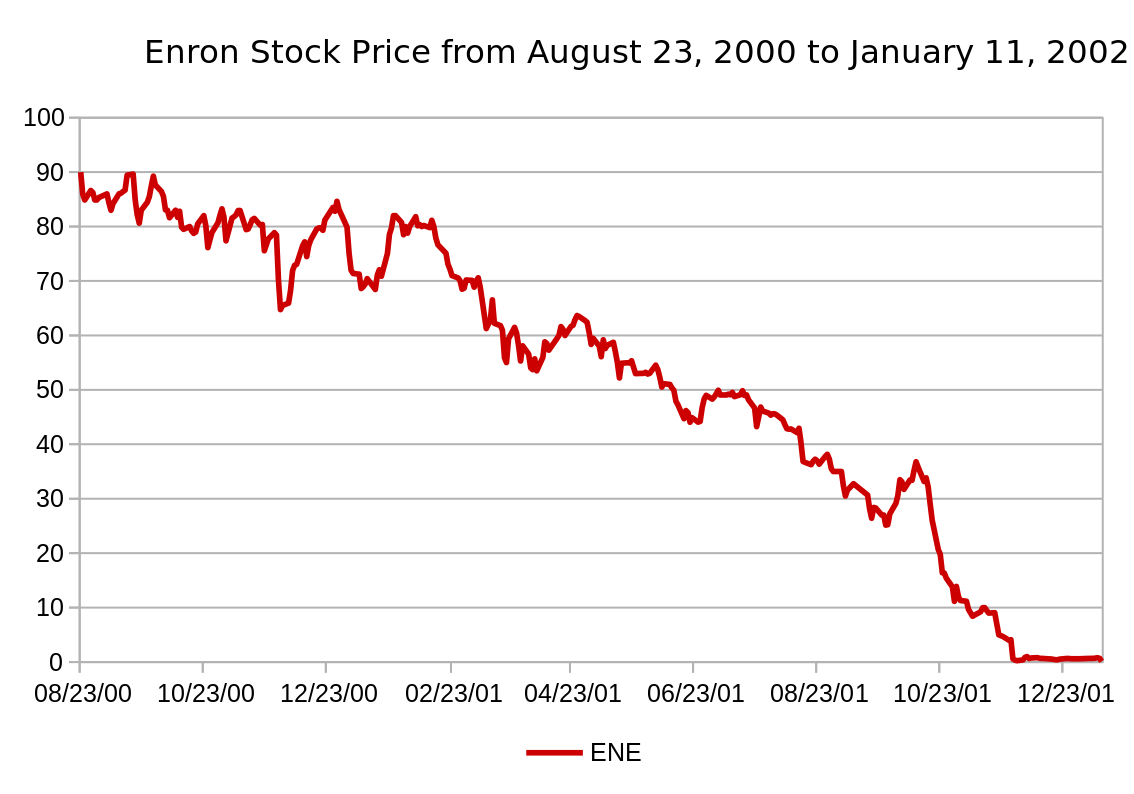

Two things happened when the story got published. The first one was obvious: Enron stock tanked. The second stunned even Weil. Enron sent their financial team and chief accounting officer to the WSJ office in Dallas to meet Weil and explain. The Enron officials openly acknowledged that the money they said they earned was virtually all money that they hoped to earn. When Weil asked them how certain they were about the money - Enron backed it’s brilliant financial brains and their mathemetical models.

Eventually ‘There was no dispute about the numbers, There was only a difference in how you should interpret them.’

The second finding was on Enron’s ‘Special-Purpose Entities’ (SPE). Enron contracted with investors and put in oil deals worth milions of dollars of expected money into each entity. They got banks to recognize these SPE’s who in turn lent money to them at very low rates. Enron created many such SPE’s but here’s the thing : it was close to impossible for an ordinary investor to understand what an SPE really constituted. The complete public documentation on all the Enron SPE’s ran into - hold your breath - 3 million pages.

Enron violated all rules with the SPE’s. They attached junk oil bonds to the SPE’s and jacked up their values. The indvidual investors of most SPE’s were Enron’s senior management themselves. Enron was contracting with itself. No one could get into this because the sheer volume of documented information on SPE’s - just the condensed summary was 1,20,000 pages. The summary of summaries reduced it to 1000 pages. The summary of summary of summaries that had only the most critical information was ‘250 mind-numbingly complex pages’ - which was done on the orders of the court.

The third clue nailed Enron completely but it had to be pointed by an independent expert - a teacher at the Colarado Law School. Enron did not pay income tax for 4 years. How did they manage that? The ‘Mark to Market’ accounting showed imaginary money on balance sheet. The SPE’s ensured bank funding was fully on. The accounting games did more than enough to fool the public and stock market.

But Enron did not pay any taxes to the IRS because it did not make real money.

Skilling resigned in Aug ‘01. Enron filed for bankruptcy in December 2001.

Everything Weil and other journalists learned to expose Enron came from Enron themselves. There have been bigger corporate scandals in history but what sets Enron apart was that they complied with all the rules - on paper. All their secrets were out in the open. They were so transparent - no body bothered to question them. It took a set of journalists who began to explore the mystery of Enron’s accounting system - dig deep into the avalanche of information to ask the right questions. And shut Enron’s financial noise to hear the truth.

These are times when most financial entities boldly claim: ‘We disclose 100%. We have nothing to hide. All our information is out there for you to access, verify and check’

But scams still happen. Common people get cheated. Financial bubbles destroy shareholder wealth. And this happens with big corporations admired for their governance. The ones who’ve always kept saying: Trust us. We disclosed everything - can’t you see? No scope for us to cheat.

The point of Enron’s story is to build competence to understand and call out not just the story in the data - but also look for the one that is conveniently hiding behind all of it.

The needed capability is not the ability to find particular information, but rather the skill to assemble disparate data points into a clear image of the whole.

Story Notes

Some of you who are familiar with the updates on Enron would know that Skilling was skilled and resourceful enough to file multiple appeals and get a reduced sentence of 14 years. The last we know is that he was planning to get started on a new energy trading start-up.

There is so much information on the Enron scandal - but the one that pointed me to pick this up was Malcolm Gladwells Open Secrets. If you have 20 minutes of time, it is the definitive piece to read. Not just on Enron - but Gladwell’s own taken on how Enron was solved by investigators who looked it as a mystery to be pursued and not a puzzle to be solved.

Nice read. I am wondering how come all the fund managers and investment bankers didn't find this odd. One part of the blame is definitely Enron. I would like to hold these folks also responsible for misleading investors of the funds. We trust them and put in money and we incurred loss!!

Interesting read!